- 2021 AND 2022 TAX BRACKETS HOW TO

- 2021 AND 2022 TAX BRACKETS ARCHIVE

- 2021 AND 2022 TAX BRACKETS CODE

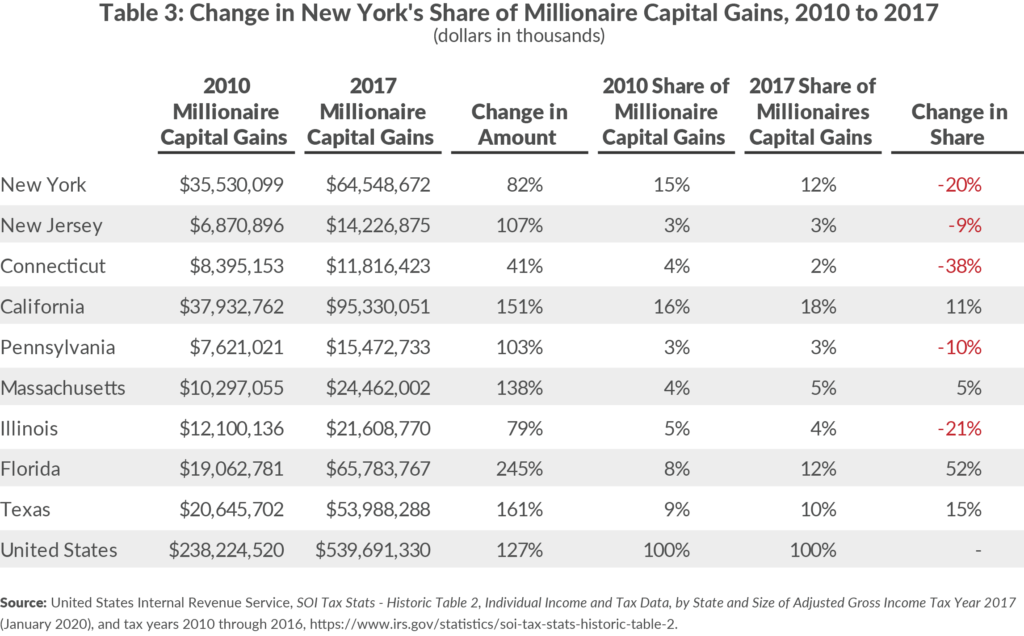

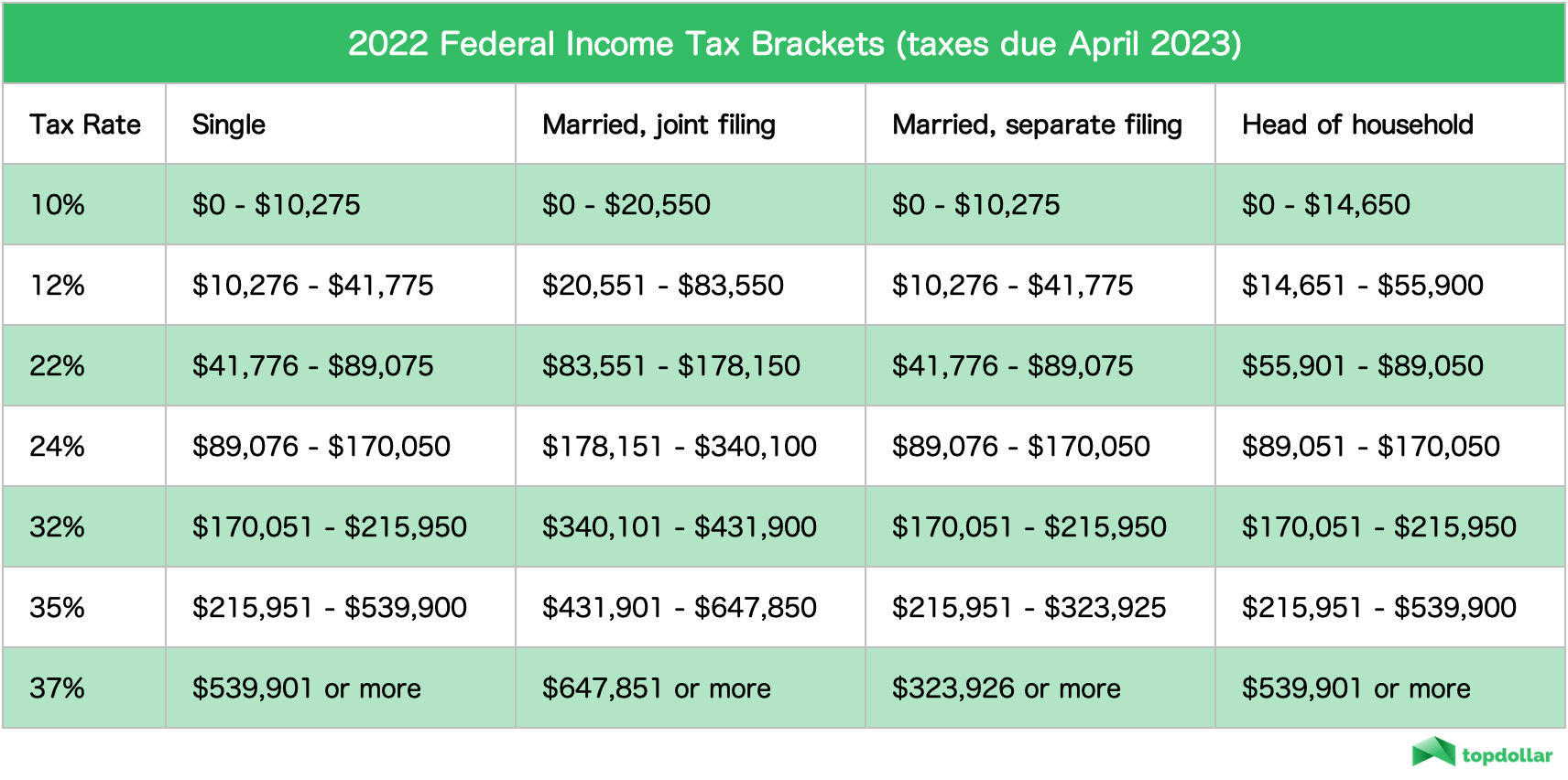

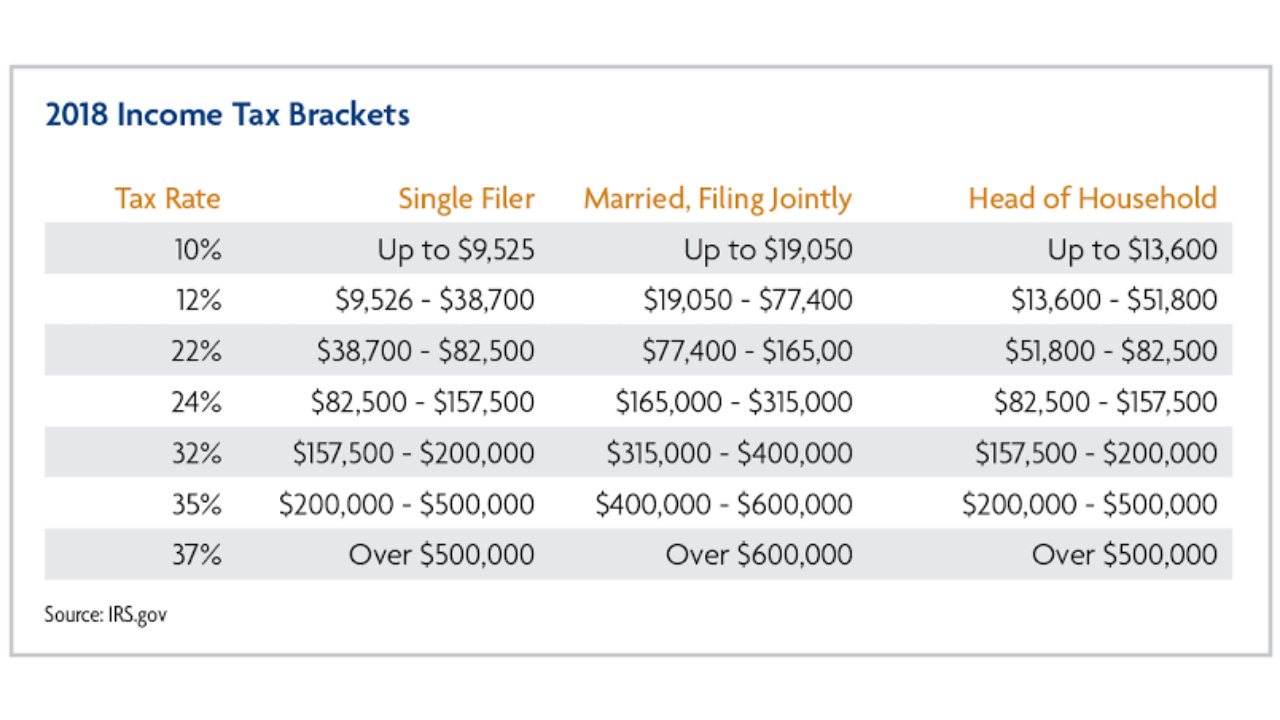

Klein, founder and chief investment officer at ALINE Wealth. "Your tax bracket is evaluated by viewing all your income, including required minimum distributions (RMDs) from IRAs, Social Security and possibly even a pension if you are fortunate to have one," says Peter J. Yours will depend on your income level and filing status. There are seven brackets for 20, ranging from 10% to 37%. The rate they pay on the last dollar is known as the marginal tax rate.

In fact, they would only pay that much on the upper-most portion of it.

However, a common misperception is that someone whose total taxable income puts them into, say, the 22% tax bracket means that they pay 22% on all of their money.

You can use tax brackets to estimate how much you'll pay in taxes for the year. To determine the tax someone owes, the government uses a system of brackets, where different chunks of a person's earnings are taxed at rates that get gradually higher as the total amount of income increases. The US uses a progressive federal income tax system.

2021 AND 2022 TAX BRACKETS ARCHIVE

Income Tax Summary Report Archive - This summary report is an analysis of Maryland resident and nonresident personal income tax returns filed for a given calendar year.Local Tax Rates: A chart depicting each county and the City of Baltimore's local income tax rates.

2021 AND 2022 TAX BRACKETS HOW TO

2021 AND 2022 TAX BRACKETS CODE

Pursuant to Annotated Code of Maryland, Tax-General Article § 10-106(b), a county must provide notice of a county income tax rate change to the Comptroller on or before July 1 prior to the effective date of the rate change. Notification of Local Rate Change to Comptroller 0275 for taxpayers with Maryland taxable income of $50,000 or less and a filing status of single, married filing separately, and dependent and 0275 for taxpayers with Maryland taxable income of $100,000 or less and a filing status of married filing joint, head of household, and qualifying widow(er) with dependent child The local tax rates for taxable year 2023 are as follows: 0281 of an individual’s Maryland taxable income in excess of $50,000. 0270 of an individual’s Maryland taxable income of $1 through $50,000 and Taxpayers Filing Joint Returns, Head of Household, or Qualifying Widows/Widowers 2022 Maryland Income Tax Rates Taxpayers Filing as Single, Married Filing Separately, Dependent Taxpayers or Fiduciaries

0 kommentar(er)

0 kommentar(er)